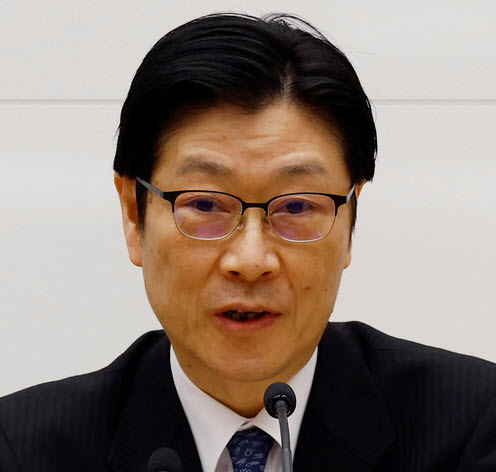

Bank of Japan deputy governor Uchida:

Japan's economy has recovered moderately, although some weakness has been seen in parts.

Japan's economic growth is likely to moderate due to the effects of trade and other policies.

Uncertainty surrounding trade policies remains extremely high.

It is important to maintain loose monetary policy to support the economy.

We expect to raise interest rates in line with economic and price improvements, if our scenario is realised.

We will judge whether the economy and prices move in line with our forecast without any pre-set idea.

It is likely that Japan's economic growth will moderate and underlying inflation will be sluggish temporarily.

It is hard to say from current data how trade talks will turn out, or which direction domestic and overseas economies and markets will move.

Overseas and Japanese economies appear to be at a critical point, with very high uncertainty.

Economic uncertainties are likely to act as downside risks to inflation.

Cost-push factors are pushing up inflation, mainly for food prices.

There are high uncertainties over Japan's economy, and risks are skewed to the downside.

These comments from BoJ Deputy Governor Uchida point to a cautious tone at the Bank, reinforcing expectations that the central bank will maintain its ultra-loose policy for now. While Uchida acknowledged a moderate recovery, he highlighted high uncertainty around trade policies, weakening growth momentum, and sluggish underlying inflation. With risks skewed to the downside and food-driven cost pressures persisting, markets are likely to temper bets on near-term rate hikes. The yen remained under pressure, and Japanese government bonds found support on the dovish read-through.

While the US and Japan have apparently reached a trade deal, Uchida, like us, has no idea what is it in it.

Full text is here: