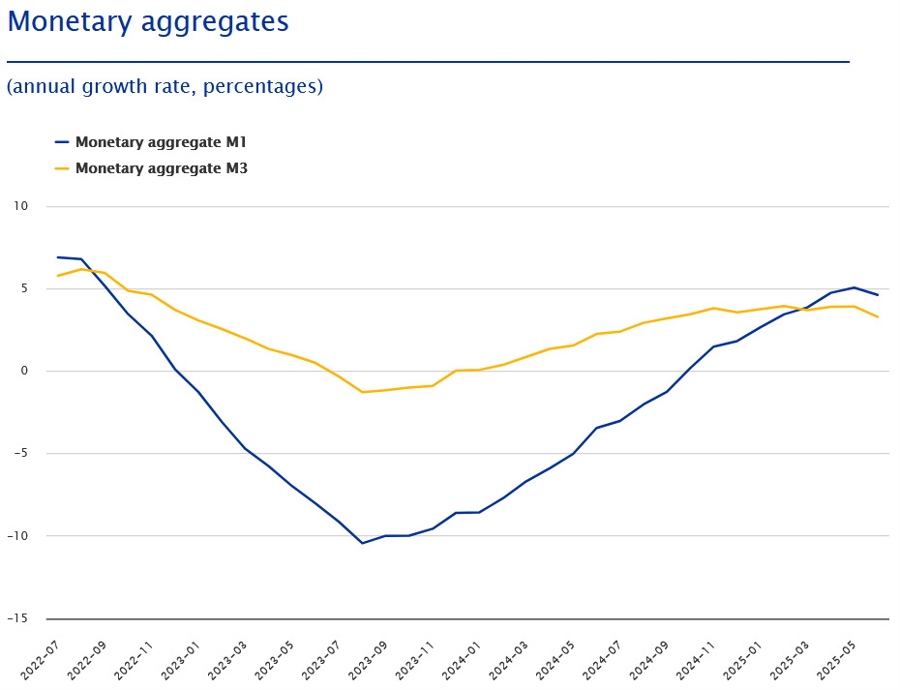

- Prior +3.9%

- Loans to households Y/Y +2.2% vs +2.0% prior

- Loans to companies Y/Y +2.7% vs +2.5% prior

This is not a market moving release. The money supply growth was expected given the ECB easing.

This is not a market moving release. The money supply growth was expected given the ECB easing.

Most Popular

Crypto liquidations top $974M as ETH, BTC slide. Altcoins dump, traders caught long. Macro stress hits tokenized commodities.

Median household income for 35-44 yr olds hit $86K in 2022. Peak earnings near 45-54. Skill rarity & sales drive pay.

Bitcoin dumps below $84.2k, social sentiment hits lows. Fear spikes signal capitulation, not euphoria. Watch for a bounce if levels reclaim!

Dividend stocks offer stability as KMB target cut; Boomers chase 5 high-yield giants for 2026 rate cuts.

US producer prices jump 0.5% in Dec, beating forecasts! Services inflation & tariffs push costs higher. Gold faces headwinds.

Bitcoin dips below $81K amid geopolitical jitters & US shutdown fears. Traders eye $80K support as ETFs see outflows.

India's harsh crypto tax drives $6.1B offshore; traders seek lower TDS & loss set-offs for fair play.

Must Read