- Prior 52.8

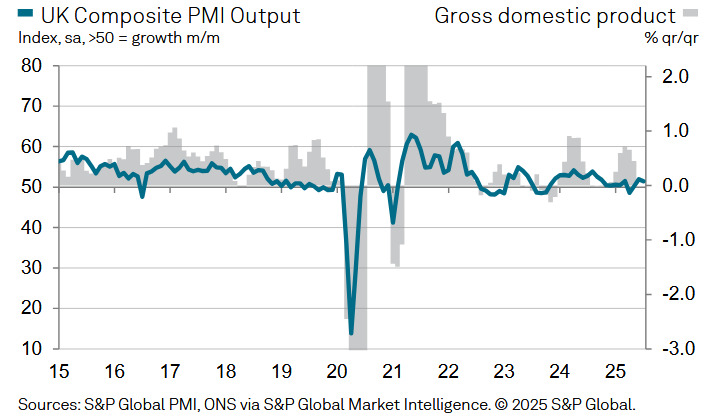

- Final Composite PMI 51.5 vs 51.0 prelim

- Prior 52.0

Key findings:

- Modest increase in service sector business activity

- Renewed fall in total new work

- Sharpest decline in employment since February

Comment:

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

"UK service providers recorded a third consecutive monthly rise in business activity, but they were unable to maintain the growth rate achieved in June.

"Moreover, new business intakes swung back into contraction during July, with the downturn in order books the fastest for just over two-and-a-half years. Risk aversion and low confidence among clients were the main reasons provided for sluggish sales pipelines, alongside an unfavourable global economic backdrop.

"Hiring trends were especially subdued, with total workforce numbers decreasing to the greatest extent since February. Worries about rising payroll costs were cited as the main factor holding back recruitment.

"Suppliers again sought to pass on rising employment costs, although the latest increase in input prices across the service economy was the slowest since December 2024.

"Despite headwinds from strong cost pressures and lacklustre domestic economic conditions, service providers remain upbeat overall regarding the year ahead business outlook. Optimism improved since June, helped by receding concerns about US tariffs and hopes of a boost to business and consumer spending from interest rate cuts in the second half of 2025."